accumulated earnings tax irs

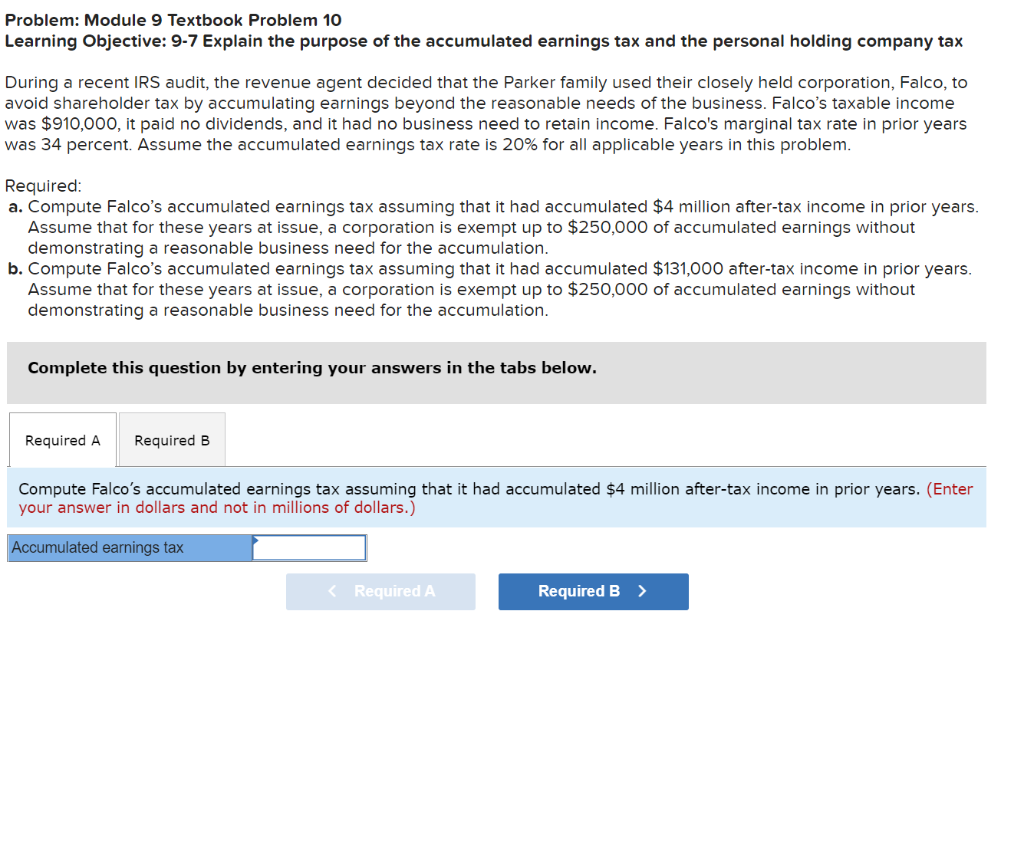

The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. Simple Strategies for Avoiding Accumulated Earnings Tax.

2014 End Of Year Tax Tips For Small Business

1 Accumulated taxable income is.

. The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax.

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the. The accumulated earnings tax can be a hidden penalty tax on highly profitable corporations that allow their earnings to accumulate without paying adequate or any. The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a much higher scheduled rate of.

The tax rate on accumulated earnings is 20 the maximum rate at which they would. The purpose of accumulated earning tax is to discourage the accumulation of profits if the purpose of such accumulation is to enable shareholders to avoid. Accumulated tax earning is a form of encouragement by the government to give out dividends rather than keeping their earnings.

Attach to Form 5471. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its. As provided in section 535 a and 1535-1 the accumulated earnings credit provided by section 535 c reduces taxable income in computing accumulated taxable income.

The Improperly Accumulated Earnings Tax IAET is a tax imposed by the Internal Revenue Service IRS on certain small businesses that are deemed to have accumulated earnings that. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or. If you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year and the trust paid taxes on that income you must complete Form.

If the IRS finds that a corporation is accumulating income for the purpose of. The accumulated earnings tax AET was put in place to prevent corporations from doing just that. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

However if a corporation allows earnings to accumulate. For instructions and the. The purpose of the tax.

An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. The tax is assessed at the highest individual tax rate. Accumulated Earnings Profits EP of Controlled Foreign Corporation.

Can An Llc Pay Corporate Tax On Retained Earnings

Earnings And Profits Computation Case Study

Fill Free Fillable Irs Pdf Forms

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

Irs Use Of Accumulated Earnings Tax May Increase

Answered During A Recent Irs Audit The Revenue Bartleby

Schedule J Accumulated E P Of Cfc Irs Form 5471 Youtube

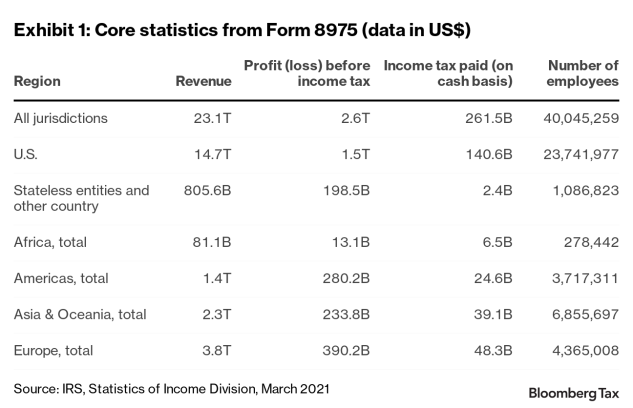

Irs Releases Country By Country Filings Insights On Tax Havens Effective Tax Rate

Accumulated Adjustment Account Aaa Schedule M 2

Global Reporting Initiative Proposes Standard For Corporate Tax Payment Practices Accounting Today

Avoiding Missteps In The Lifo Conformity Rule

Tax Benefits For Education Information Center Internal Revenue Service

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template

What Are Accumulated Retained Earnings

How Should Llcs Handle Corporate Tax On Retained Earnings

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

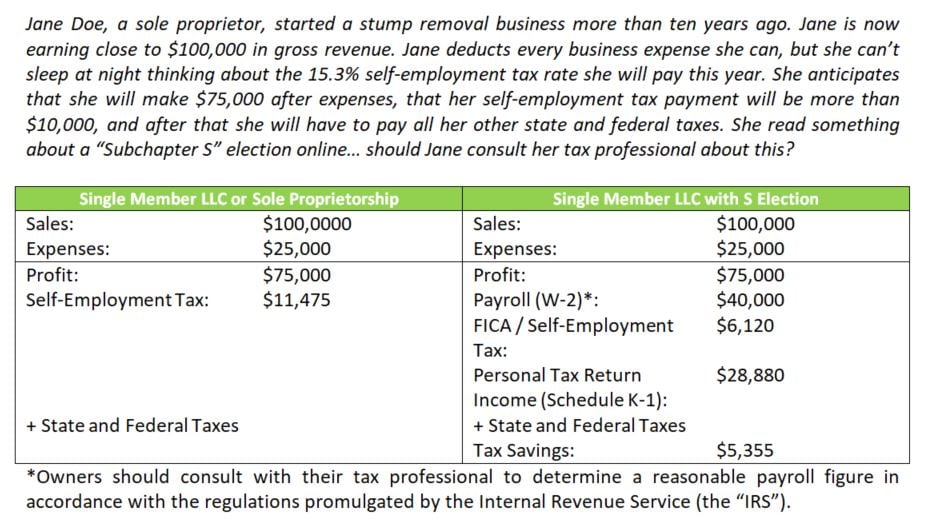

What Is An S Corp And Why Should You Consider One

Dormant Foreign Corporations And Form 5471 Rev Proc 92 70 1992 2 C B 435 Htj Tax